osceola county property tax payment

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location.

Osceola County Tax Collector Office Of Bruce Vickers Serving Our Citizens With Dignity Respect

The median property tax on a 19920000 house is 209160 in the United States.

. What is the due date for paying property taxes in Osceola county. Tonia Hartline 301 W. This service allows you to make a tax bill payment for a specific property within your Municipality.

When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of. Official Payments Corporation the service provider charges a convenience fee for payment processing. Enjoy online payment options for your convenience.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. The median property tax on a 19920000 house is 193224 in Florida. Taxpayers may also make property tax.

Osceola County Circuit Court Kissimmee Florida Online ticket payment portal. Summer taxes are due by September 14 without interest. Discover Mastercard Visa and e-Check are accepted for Internet Transactions.

Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. This calculator can only provide you with a rough estimate of your tax liabilities based on the. If you dont pay by the due date you will be charged a penalty and interest.

Welcome to the Tax Online Payment Service. Search Use the search critera below to begin searching for your. Osceola Tax Collector Website.

All personal property taxes are payable to the Village of Osceola and due by January 31st of. The Mississippi County Treasurer and Tax Collectors Office is part of the Mississippi County Finance Department that encompasses all. Irlo Bronson Memorial Hwy.

Irlo Bronson Memorial Hwy. Osceola County Property Appraiser. The Mississippi County Tax Collector located in Osceola Arkansas is responsible for financial transactions including issuing Mississippi County tax bills collecting personal and real property tax payments.

All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. Learn how Osceola County levies its real property taxes with our detailed review.

Irlo Bronson Memorial Hwy. Phone 407 742-3583 Fax 407 742-3569. Please correct the errors and try again.

The median property tax on a 19920000 house is 189240 in Osceola County. First Half of Taxes DUE Septmeber 1st. The second half of real estate taxes and delinquent taxes are due to the Polk County Treasurer by July 31st of each year.

Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. And the taxpayer will be required to pay the taxes due in full by March 31st. OSCEOLA COUNTY TAX COLLECTOR.

The Tax Collectors Office provides the following services. Taxpayers can call Personal Teller at 877-495-2729. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Traffic parking speeding and most other tickets and court payments can be paid online here. OSCEOLA COUNTY TAX COLLECTOR. Osceola County Tax Collector - Office of Bruce Vickers.

Your account number is your parcel number that begins with 67. Welcome to Osceola County Iowa. Search all services we offer.

You can talk to a live agent to pay with eCheck credit or debit card. Pay Property taxes in Osceola County Florida with this online service. 2 Courthouse Square Suite 2000 Kissimmee Florida 34741.

Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes. Pay Property Taxes Online in Osceola County Michigan using this service. In-depth Osceola County FL Property Tax Information Assess all the factors that determine a propertys taxes with a detailed report like the sample below.

Tangible personal property tax is an ad valorem tax assessed against the furniture fixtures and equipment located in businesses and rental property. To begin please enter the appropriate information. Visit their website for more information.

2505 E Irlo Bronson Memorial Highway. BRUCE VICKERS CFC CFBTO ELC. Property taxes are due on September 1.

When are taxes due. Winter taxes are due by February 14 without penalty. Create a free account and review your selected propertys tax rates value assessments and more.

Osceola County Clerk Of The Circuit Court

Osceola County Property Appraiser How To Check Your Property S Value

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Tax Collector S Office Bruce Vickers Facebook

Osceola County Property Appraiser Open Data

Pin By Michele Mehnert On Homebuying Business Tax Property Tax Home Buying

Property Tax Search Taxsys Osceola County Tax Collector

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Curriculum Amp Instruction Consent Agenda Osceola County School

School Board Meeting Agenda Packet Osceola County

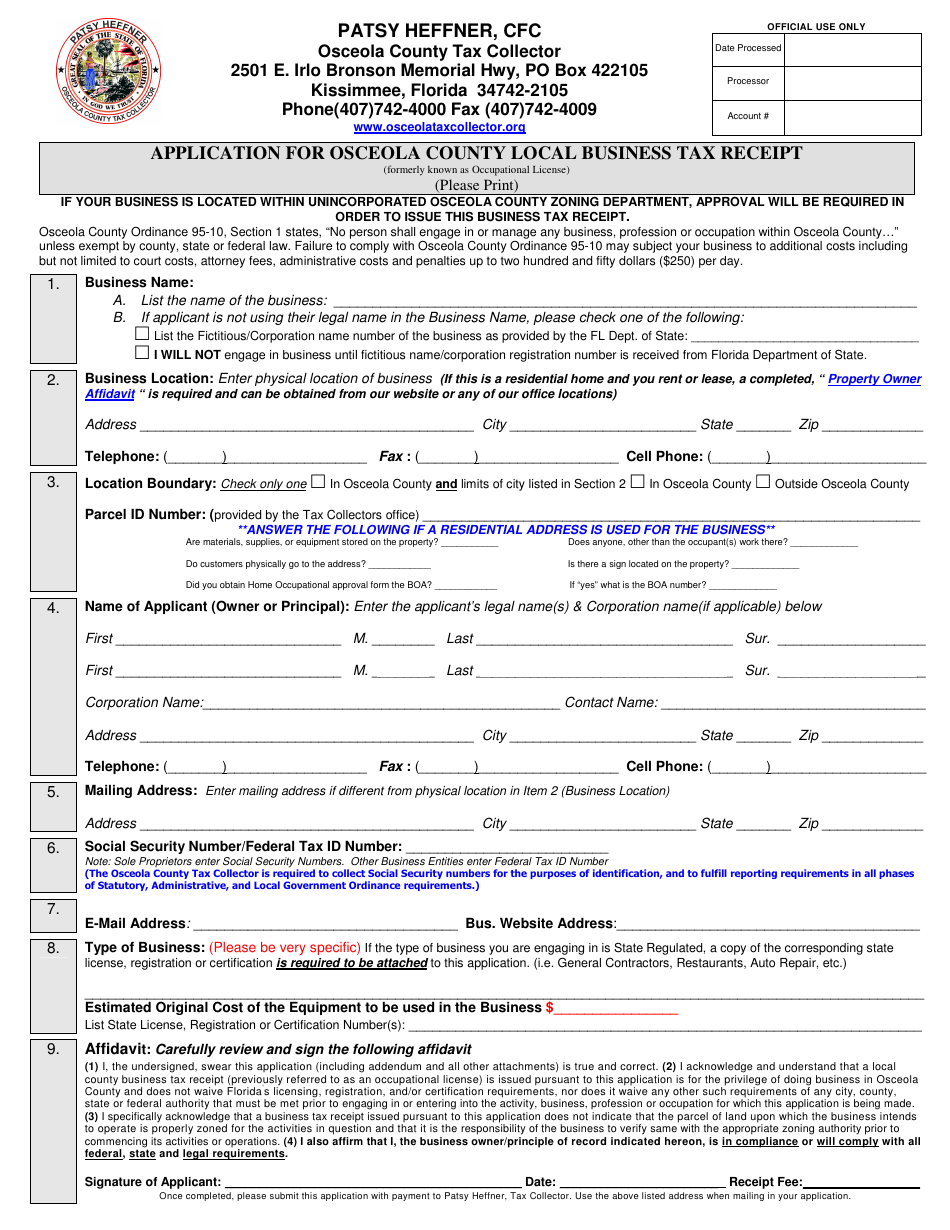

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Florida Wikiwand

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Online Payments Osceola County Tax Collector Office Of Bruce Vickers